Posted On: July 1, 2024 by Peoples Bank of Kankakee County in: Personal Finances

In today's fast-paced world, financial literacy is more important than ever! Understanding how to manage money, save, invest, and plan for the future is essential for financial well-being. At Peoples Bank, we believe in empowering individuals at every stage of life with the knowledge and tools needed to make informed financial decisions.

Below we explore financial literacy for different age groups and highlight how Peoples Bank supports financial education in the community!

The Importance of Financial Literacy

Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, and investing. It forms the foundation for effective financial decision-making and is crucial for achieving financial stability and success. By promoting financial literacy, we aim to help individuals make smarter financial choices, avoid common pitfalls, and build a secure financial future.

Financial Education for All Ages

1. Teaching Kids About Money and Saving

It's never too early to start teaching kids about money. Early financial education can help children develop healthy money habits that will last a lifetime.

-

Introduction to Money: Teach kids about different denominations of money and their values.

-

Saving Basics: Encourage saving by using a piggy bank or a savings account.

-

Budgeting: Explain the concept of budgeting with simple examples, such as saving for a toy or a treat.

2. Budgeting and Financial Planning for Teenagers and College Students

As teenagers and college students begin to earn money from part-time jobs or allowances, it's crucial to instill good financial habits.

-

Creating a Budget: Help them create a budget to manage their income and expenses.

-

Understanding Credit: Teach the basics of credit and the importance of maintaining a good credit score.

-

Saving for the Future: Encourage them to save for future goals, such as college or a car.

3. Managing Finances as a Young Adult: Loans, Credit, and Investments

Young adulthood is a critical time for establishing a strong financial foundation.

-

Credit Management: Educate on the responsible use of credit cards and the impact of credit scores.

-

Student Loans: Provide information on managing and repaying student loans.

-

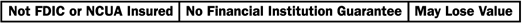

Investing: Introduce the basics of investing and the importance of starting early to build wealth over time.

4. Retirement Planning and Financial Management for Seniors

For seniors, financial literacy focuses on managing retirement savings and ensuring financial security.

-

Retirement Accounts: Explain different types of retirement accounts and distribution strategies.

-

Healthcare Costs: Provide guidance on managing healthcare expenses and understanding Medicare.

-

Estate Planning: Highlight the importance of estate planning, including wills and trusts.

Resources and Tools for Financial Literacy

In addition to our in-person and online resources, we recommend the following tools to enhance your financial literacy:

-

Budgeting Apps: Utilize apps like Mint or YNAB (You Need a Budget) to track your spending and manage your budget.

-

Financial Calculator Library: Using the financial calculators available on Peoples Bank’s website, you can get a better sense of what the future holds for your finances.

-

Educational Websites: Explore websites such as Investopedia and the Financial Literacy and Education Commission for comprehensive financial education.

-

Books: Research and read books focused on valuable financial insights.

Conclusion

Financial literacy is a lifelong journey that evolves with each stage of life. By equipping yourself with the knowledge and tools to manage your finances effectively, you can achieve financial stability and success. At Peoples Bank, we're here to support you every step of the way with tailored resources and personalized service. Whether you're teaching your child about saving, navigating student loans, or planning for retirement, we’re committed to helping you build a strong financial foundation.

Experience the difference of banking with Peoples Bank and take control of your financial future today!